how are rsus taxed in the uk

You only pay tax on RSUs when they vest. During the first quarter 2022 the Company generated 54 of its revenue from Australia 41 from the US and 5 in the UK Canada and other geographies.

Rsus Vs Nqsos Financial Planning Tips For Expat Executives At Multinationals Creveling Creveling Private Wealth Advisory

The performancelinked award of six million shares to be executed through five tranches of 12-m shares till.

. Gross profit was 55 million or 476 of revenue compared to 40 million or 487 of revenue in the same quarter of 2021. The UK tax treatment for RSUs is similar to how your salary is taxed. In all cases there is no tax to pay when RSUs are granted.

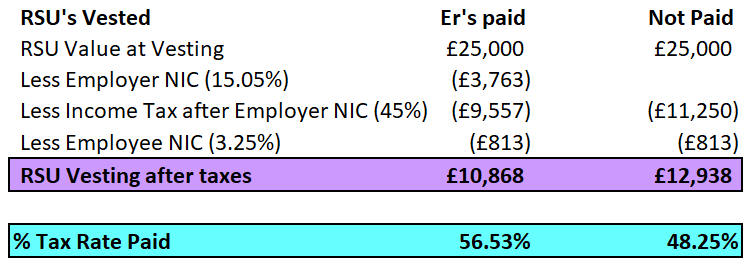

The Freshworks board had okayed the award in a pre-IPO decision in September last year with a third of the nine million share award routed as Restricted Stock Units RSUs that began vesting with him beginning November last year. You may also need to pay for employers national insurance. When your RSUs vest you will pay income tax and employee national insurance.

The Freshworks board had okayed the award in a pre-IPO decision in September last year with a third of the nine million share award routed as Restricted Stock Units RSUs that began vesting with him beginning November last year. The employee can pay taxes similarly to an RSU award with the fair market value of the restricted stock. VIQ or the Company TSX and Nasdaq.

VQS a global provider of secure AI-driven digital voice and video capture technology. The Company adopted its 2019 Omnibus Stock Incentive Plan the 2019 Plan which provides for the issuance of stock options stock grants and RSUs to employees directors and consultants. The performancelinked award of six million shares to be executed through five tranches of 12-m shares till.

The tax treatment of restricted stock awards comes down to a choice by the employee. However a violation of any Canadian laws and regulations such as the CDSA or of similar legislation in the other jurisdictions including Finland EU and the United Kingdom could result in significant fines penalties administrative sanctions convictions or settlements arising from civil proceedings initiated by either government. VIQ Solutions Inc.

The primary purpose of the 2019 Plan is to enhance the ability to attract motivate and retain the services of qualified employees officers and directors.

Draft Finance Bill 2016 Restricted Stock Units

How To Report Rsu On Tax Return Uk Ictsd Org

Restricted Securities Also Known As Restricted Share Units Rsu S

Rsa Vs Rsu Everything You Need To Know Global Shares

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

How Are Restricted Stock Units Taxed In The Uk Ictsd Org

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

Taxation Of Restricted Stock Units Rsus

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

Tax Efficiency Around Rsus The Lemon Fool

Draft Finance Bill 2016 Restricted Stock Units

Draft Finance Bill 2016 Restricted Stock Units

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

Bambridge Accountants Us And Uk Chartered Accountants